Wondering how non-taxable income factors into your mortgage approval? In this post, we’ll explain what…

FHA Mortgage Insurance Basics

Are you curious about FHA mortgage insurance and how it affects your home loan in Colorado Springs? Understanding the mortgage insurance premium rates is crucial for evaluating the overall cost of your FHA mortgage insurance. In this post, we’ll explain what FHA mortgage insurance is, how it works, when it can be canceled, and why it’s an important factor for many Colorado homebuyers. Let’s dive in so you can understand your options and make informed decisions with 719 Lending by your side.

What Is FHA Mortgage Insurance?

FHA mortgage insurance is a policy that protects lenders when they issue loans backed by the Federal Housing Administration (FHA). It’s designed to encourage mortgage professionals to offer loans to buyers who might not qualify for conventional mortgages by meeting FHA mortgage insurance requirements—often due to lower credit scores or smaller down payments.

FHA mortgage insurance is mandatory for loans secured through FHA-approved lenders, who must disclose the costs associated with this insurance during the loan estimation process.

In exchange for this extra security, FHA borrowers pay a mortgage insurance premium (MIP). Because FHA loans can be more accessible to first-time homebuyers, these MIP costs help ensure lenders remain confident in issuing these loans.

What is Mortgage Insurance?

Mortgage insurance is a type of insurance that protects lenders against losses resulting from defaults on home mortgages. It is typically required for borrowers who make a down payment of less than 20% of the purchase price of the home. Mortgage insurance can be either private mortgage insurance (PMI) or government-backed insurance, such as Federal Housing Administration (FHA) mortgage insurance. To better understand your potential costs, you can use an FHA mortgage insurance calculator to estimate your premiums.

Private mortgage insurance is usually associated with conventional loans, while FHA mortgage insurance is provided by the Federal Housing Administration (FHA). The FHA mortgage insurance is designed to make homeownership more accessible, especially for those with lower credit scores or smaller down payments. By offering this insurance, the Federal Housing Administration helps ensure that lenders are willing to approve loans for a broader range of borrowers.

Protects the lender in case of borrower default

Mortgage insurance plays a crucial role in protecting the lender if the borrower defaults on their mortgage payments. If the borrower fails to make their mortgage payments, the lender can file a claim with the mortgage insurance company to recover some or all of the losses. This safety net reduces the risk for the lender, making them more likely to offer loans to borrowers who might not meet the stringent requirements of conventional loans.

For borrowers, this means that mortgage insurance can open doors to homeownership that might otherwise remain closed. By mitigating the lender’s risk, mortgage insurance allows for more flexible lending criteria, which can be particularly beneficial in competitive housing markets like Colorado Springs. In some cases, borrowers may be eligible for an FHA mortgage insurance refund if they refinance their loan.

Required for FHA loans with low down payments

FHA loans with low down payments, typically less than 20% of the purchase price, require mortgage insurance premiums (MIP) to protect the lender against potential losses. The Federal Housing Administration (FHA) mandates both upfront and annual mortgage insurance premiums for all borrowers, regardless of the down payment amount.

The upfront mortgage insurance premium (UFMIP) is a one-time fee paid at closing, usually amounting to 1.75% of the loan amount. This fee can be paid in full at closing or financed into the loan, which will increase the overall cost of the loan. On the other hand, the annual mortgage insurance premium (MIP) is a recurring charge that is divided into monthly installments and added to your mortgage payments.

The cost of these mortgage insurance premiums varies based on several factors, including the loan amount, loan term, and loan-to-value (LTV) ratio. Borrowers with lower credit scores or higher debt-to-income ratios may face higher mortgage insurance premiums.

To estimate your mortgage insurance premiums, you can use an FHA mortgage calculator. This tool helps you explore different scenarios and understand how various factors affect your premiums. It’s also essential to carefully review the terms and conditions of your FHA loan, including the mortgage insurance premiums, before signing the loan agreement.

Shopping around for FHA-approved lenders can also be beneficial. Different lenders may offer varying rates and terms, including mortgage insurance premiums, so comparing options can help you find the best deal. The FHA provides resources and tools, such as the FHA Mortgage Insurance Premium (MIP) Calculator, to help borrowers understand and manage their mortgage insurance premiums.

For personalized guidance, consider contacting FHA-approved lenders or housing counseling agencies. They can provide valuable insights and help you navigate the mortgage insurance premium requirements for FHA loans, ensuring you make informed decisions about your home loan.

How FHA Mortgage Insurance Premiums Work

FHA mortgage insurance typically has two parts:

- Upfront Mortgage Insurance Premium (UFMIP): This is a one-time fee due at closing. Most FHA loans charge 1.75% of the loan amount for UFMIP. You can either pay this amount in full at closing or roll it into your loan balance.

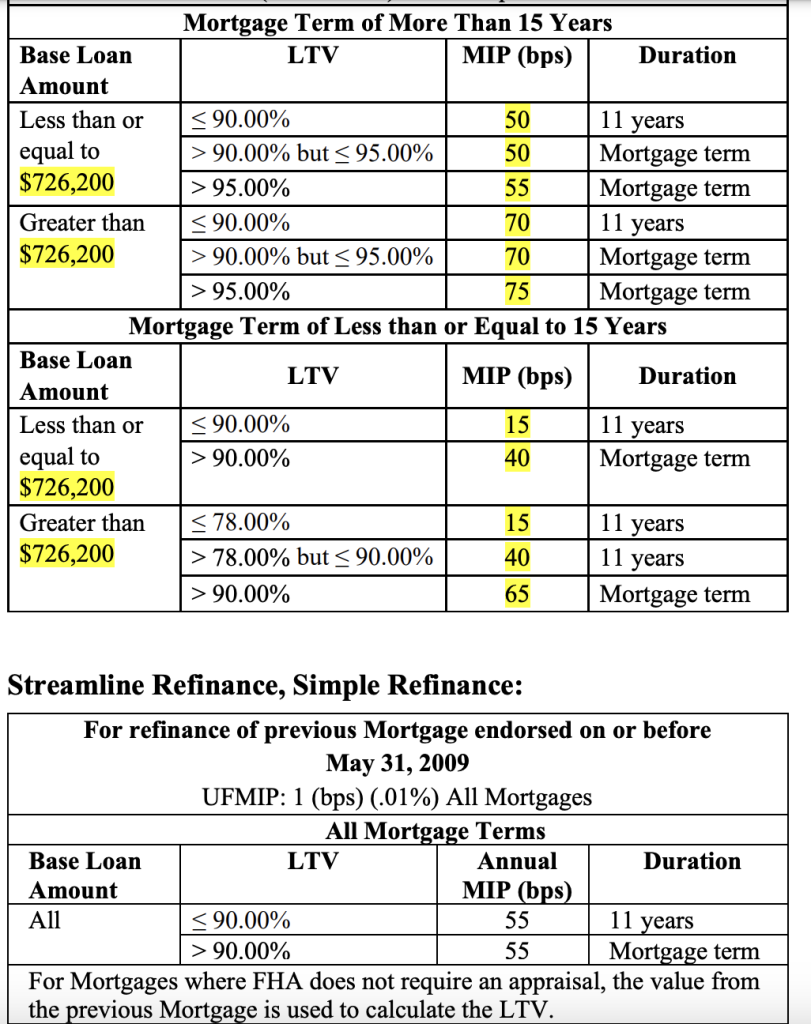

- Annual Mortgage Insurance Premium (Annual MIP): This is a yearly fee broken down into monthly payments. Your exact rate depends on factors like your loan amount and term length (often 15 or 30 years). Most borrowers pay between 0.45% and 1.05% of the loan amount as an annual premium. Annual mortgage insurance premiums (MIP) protect lenders from losses due to borrower defaults and have seen recent adjustments to costs, affecting borrowers. Borrowers who refinance their FHA loans may be eligible for an FHA mortgage insurance premium refund.

Here’s what you need to know next: These premiums can make your monthly payments higher than a conventional loan’s private mortgage insurance (PMI). However, the trade-off is that FHA loans are generally easier to qualify for, especially in competitive housing markets like Colorado Springs.

Official FHA Resources

- HUD’s Official Guidelines For FHA Mortgage Insurance

- FHA Requirements For Mortgage Insurance

- FHA Mortgage Insurance Premium Chart – A detailed chart outlining the different premium rates based on loan terms and amounts.

Calculating Mortgage Insurance Payments

Calculating mortgage insurance payments can be complex, as it depends on several factors, including the loan amount, loan term, and loan-to-value (LTV) ratio. Here are the general steps to calculate mortgage insurance payments:

- Determine the Loan Amount and Loan Term: Start by identifying the total loan amount and the length of the loan term.

- Calculate the LTV Ratio: Divide the loan amount by the purchase price of the home to get the LTV ratio.

- Determine the Mortgage Insurance Premium Rate: Based on the LTV ratio and loan term, find the applicable FHA mortgage insurance premium rates.

- Calculate the Annual Mortgage Insurance Premium: Multiply the loan amount by the premium rate to get the annual mortgage insurance premium.

- Calculate the Monthly Mortgage Insurance Premium: Divide the annual premium by 12 to determine the monthly mortgage insurance premium.

For example, let’s say you purchase a home for $200,000 with a 10% down payment ($20,000) and a 30-year FHA loan. The loan amount is $180,000, and the LTV ratio is 90%. If the mortgage insurance premium rate is 0.85% per year, the annual mortgage insurance premium would be $1,530 ($180,000 x 0.85%), and the monthly premium would be $127.50 ($1,530 ÷ 12).

It’s important to note that mortgage insurance premiums can vary depending on the lender and the specific loan program. Borrowers should carefully review their loan terms and conditions to understand their mortgage insurance obligations fully. By doing so, they can better manage their mortgage payments and plan for the future.

When Can FHA Mortgage Insurance Be Canceled?

Canceling your FHA mortgage insurance depends on several factors, including the date you took out your loan and the size of your down payment. According to HUD’s rules:

- Loans Originated Before June 3, 2013: You may be able to remove the annual MIP when your loan-to-value (LTV) ratio reaches 78% (meaning you’ve paid your loan balance down to 78% of the original amount).

- Loans Originated On or After June 3, 2013: You typically must pay MIP for the life of the loan if your down payment is less than 10%. If you put down 10% or more, you may be able to remove MIP after 11 years.

In some cases, borrowers may be eligible for an FHA mortgage insurance premium refund if they meet certain conditions.

If you have an FHA loan, you might explore refinancing into a conventional mortgage once your credit score and equity improve. That can help you drop mortgage insurance costs altogether—especially if your home’s value in Colorado has risen, which is common in high-demand areas like Colorado Springs. Refinancing a current FHA loan to another FHA loan impacts UFMIP refunds and the continuing requirement to pay MIP based on certain conditions related to the down payment made when purchasing the home.

Why FHA Loans Are Popular In Colorado Springs

Colorado Springs real estate offers plenty of opportunities for both first-time homebuyers and current homeowners looking to upgrade. Yet, housing prices can be challenging for those who don’t have a large down payment or a near-perfect credit score. FHA loans help bridge that gap. Refinancing an FHA loan to a new FHA loan can help manage mortgage insurance premiums (MIP) and upfront premiums (UFMIP), and under certain conditions, mortgage insurance can be canceled. Understanding FHA mortgage insurance premium rates can help you better evaluate the overall cost of your loan.

Here are a few reasons FHA loans remain a top choice in Colorado:

- Lower Down Payment Requirements: Borrowers can pay as little as 3.5% down.

- Flexible Credit Score Standards: You may qualify with a score that’s lower than what conventional loans require.

- Competitive Interest Rates: FHA-insured loans often feature interest rates that are comparable to some conventional loans.

Tips For Reducing FHA Mortgage Insurance Costs

- Make a Larger Down Payment Putting down at least 10% can help you remove the annual MIP after 11 years instead of paying for the entire life of the loan. Borrowers who make a down payment of less than 20 percent on their home are required to pay mortgage insurance, which includes Mortgage Insurance Premiums (MIP) for FHA loans and Private Mortgage Insurance (PMI) for conventional loans.

- Improve Your Credit Score A higher credit score can help you secure better loan terms. Over time, you may qualify for a refinance, eliminating MIP once you switch to a conventional mortgage.

- Consider Shorter Loan Terms A 15-year FHA mortgage may have lower annual mortgage insurance rates. However, monthly payments can be higher.

- Keep An Eye On Your Home Equity Colorado Springs home values have trended upward. That could help you build equity faster, making it easier to refinance out of the FHA mortgage insurance requirement.

- Explore Refund Options Borrowers who refinance their FHA loans may be eligible for an FHA mortgage insurance premium refund, which can help reduce overall costs.

FAQ: Common Questions About FHA Mortgage Insurance

1. Does FHA Mortgage Insurance Apply To All FHA Loans?

Yes. FHA mortgage insurance applies to all FHA loans, although the cost and duration can vary. Additionally, borrowers who refinance their FHA loans may be eligible for an FHA mortgage insurance premium refund.

2. Is FHA MIP The Same As PMI?

Not quite. Private Mortgage Insurance (PMI) typically applies to conventional loans. FHA MIP is similar in purpose but is managed by the Federal Housing Administration. Borrowers who refinance their FHA loans may also be eligible for an FHA mortgage insurance premium refund.

3. Can I Cancel FHA MIP Early?

Most borrowers cannot cancel MIP early unless they refinance into a conventional loan or meet certain down payment and timing requirements. Check your loan details or speak with a loan officer at 719 Lending for personalized guidance.

In some cases, refinancing your FHA loan may also make you eligible for an FHA mortgage insurance premium refund.

Ready To Explore Your Options?

If you live in Colorado Springs or anywhere else in Colorado, 719 Lending is here to guide you through the FHA mortgage process. Our team of mortgage professionals will explain your options, help you understand your FHA mortgage insurance, and explore solutions—such as refinancing—to fit your goals. Our team can also help you explore options for an FHA mortgage insurance premium refund if you refinance your loan.

For even more guidance, make sure to check out our Home Loan Options to see how we can support your journey toward homeownership or refinancing.

Still have questions about FHA mortgage insurance or Colorado Springs real estate? Contact 719 Lending today and let our friendly, knowledgeable loan officers help you find your best path forward.

Additional Resources

- Consumer Financial Protection Bureau – Offers general information on mortgages and consumer rights.

- HUD’s Official Guidelines For FHA Mortgage Insurance – Detailed rules on premiums.

- FHA Requirements For Mortgage Insurance – Explains mortgage insurance for FHA loans.

- FHA Mortgage Insurance Premium Refund – Information on eligibility and how to apply for a refund.

FHA mortgage insurance can be a game-changer for anyone looking to secure a home in Colorado Springs with a lower down payment or less-than-perfect credit. By understanding these requirements, exploring cancellation options, and working with a trusted mortgage lender like 719 Lending, you’ll be well on your way to making confident, informed decisions about your Colorado home.