Why Spring is a Prime Time for Real Estate Spring consistently ranks as one of…

Homeownership Net Worth

Homeownership Net Worth: Building Financial Stability and Wealth

As you strive towards financial stability and wealth, it’s crucial to consider the role of homeownership net worth in achieving your goals. Homeownership net worth is defined as the total value of assets you accumulate through owning a home, minus the outstanding mortgage balance. Homeownership can provide an excellent opportunity for asset growth and financial stability, and 719 Lending can guide you through the process of achieving it.

Homeownership net worth can have a positive impact on your overall financial standing, enabling you to build equity and accumulate wealth over time. In this article, we’ll explore the essential aspects of homeownership net worth and how it can help you achieve financial stability and grow your wealth.

Key Takeaways

- Homeownership net worth is the value of assets accumulated through owning a home, minus the outstanding mortgage balance.

- Homeownership can provide an excellent opportunity for asset growth and financial stability.

- 719 Lending can guide you through the process of achieving homeownership and increasing your net worth through property ownership.

The Importance of Homeownership

Homeownership is one of the most important investments you can make for your financial future. By owning a home, you have the potential to increase your net worth and build long-term wealth. With the right strategies, you can maximize your homeownership net worth and improve your overall financial standing.

One of the ways homeownership can boost your net worth is through the appreciation of your property value. As home values generally increase over time, your home equity can grow, allowing you to accumulate wealth. Additionally, owning a home can provide a sense of stability and security, which can lead to better financial decisions.

There are several strategies to boost your net worth through homeownership, including making additional mortgage payments, increasing your home’s value through home improvements, and utilizing home equity for investment purposes. By taking advantage of these strategies, you can unlock the true potential of homeownership net worth and build a strong financial future for yourself and your family.

Understanding Net Worth

Net worth is the difference between your total assets and your total liabilities. Essentially, it’s a measure of your financial health and your ability to meet financial goals. Your net worth can increase over time as you accumulate assets and pay down debt.

One major factor that can contribute to net worth growth is home equity. Home equity is the value of your home minus any outstanding mortgage debt. As you pay down your mortgage, your home equity increases, which directly impacts your net worth.

Additionally, owning a home can serve as a means of acquiring assets. For example, if your home appreciates in value over time, you may be able to sell it for a profit and use the proceeds to invest in other assets. This can further boost your net worth and help you achieve long-term financial goals.

The Relationship Between Home Equity and Net Worth Growth

Home equity plays a significant role in net worth growth. As you pay down your mortgage, your home equity increases, and the value of your home appreciates over time. This results in a larger net worth and a more secure financial future.

Table: Impact of Home Equity on Net Worth Growth

| Year | Home Value | Mortgage Balance | Home Equity | Net Worth |

|---|---|---|---|---|

| Year 1 | $250,000 | $200,000 | $50,000 | $50,000 |

| Year 5 | $300,000 | $150,000 | $150,000 | $200,000 |

| Year 10 | $350,000 | $100,000 | $250,000 | $350,000 |

The table above highlights the impact of home equity on net worth growth over time. As the home value increases, the home equity and net worth also increase. By year 10, the home equity has grown to $250,000, resulting in a net worth of $350,000.

Acquiring assets through homeownership is another way to boost net worth growth. By leveraging the equity in your home, you can invest in other assets, such as stocks, bonds, or real estate. This diversifies your investment portfolio and can potentially lead to higher returns and increased net worth over time.

By understanding the relationship between net worth, home equity, and acquiring assets through homeownership, you can make informed decisions about your financial future and work towards achieving your long-term financial goals.

If you’re trying to decide whether to rent or buy a home this year, here’s a powerful insight that could give you the clarity and confidence you need to make your decision.

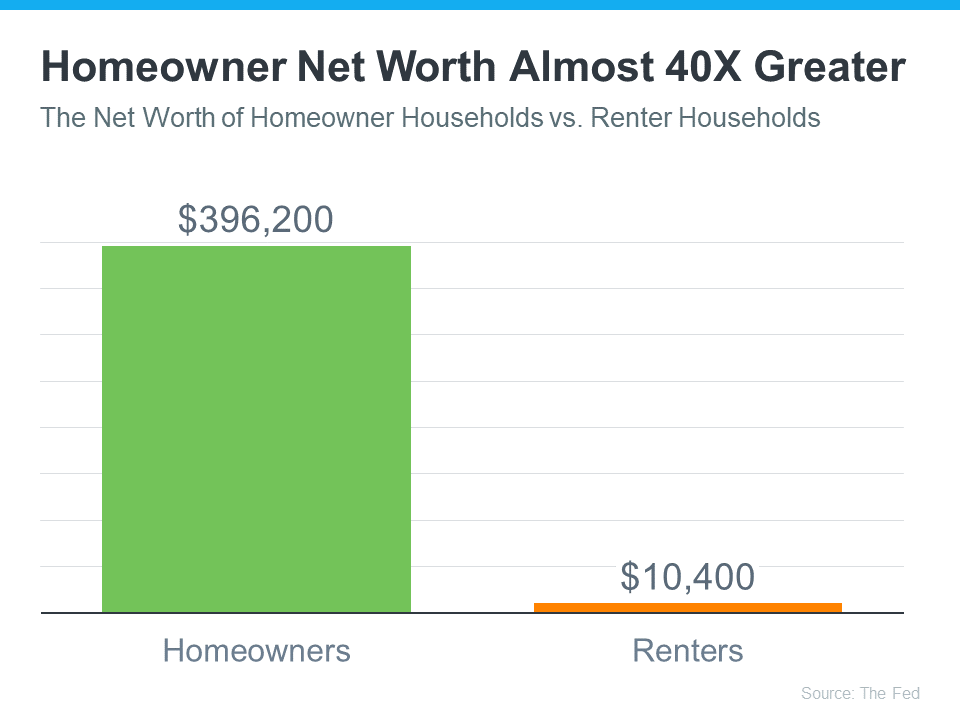

Every three years, the Federal Reserve releases the Survey of Consumer Finances (SCF), which compares net worth for homeowners and renters. The latest report shows the average homeowner’s net worth is almost 40X greater than a renter’s (see graph below):

The Impact of Homeownership on Financial Stability

Owning a home is one of the most significant investments you can make. Homeownership provides several benefits, including building equity and stability. One of the main advantages of owning a home is its positive impact on your financial stability.

Firstly, homeownership provides stability through fixed monthly mortgage payments. When you rent a property, you are subject to rising rents, and landlords may decide to sell the property, leaving you without a place to live. But when you own a home, you have a fixed mortgage payment, which allows you to budget and plan your finances accordingly, providing peace of mind and financial stability.

Secondly, homeownership offers potential tax benefits. Depending on your region, the interest you pay on your mortgage, and other factors, you may be eligible for deductions on your federal income tax return. These deductions can significantly reduce your tax bill, freeing up money to save and invest, further improving your financial stability.

Finally, owning a home provides a sense of control over housing expenses. Unlike renting, where landlords may increase rent annually or as they see fit, homeowners have more control over their housing costs. Maintenance and repair costs may arise, but homeowners can plan for them and make informed decisions about their maintenance expenses. Owning a home allows you to have more control over your finances, contributing to your financial stability.

In summary, owning a home provides stability through fixed monthly mortgage payments, potential tax benefits, and a sense of control over housing expenses, contributing significantly to your financial stability.

Building Wealth Through Owning a Home

Homeownership offers numerous advantages for building wealth and increasing net worth. One of the key ways that homeownership can boost your net worth is through real estate appreciation. Real estate generally tends to appreciate over time, meaning that the value of your property will likely increase as the years go by. This can enable you to build equity that can be leveraged for other investments or financial goals.

Another way that homeownership can help you build wealth is by allowing you to take advantage of tax benefits. For example, you may be able to deduct the interest paid on your mortgage from your taxable income, lowering your overall tax bill.

Finally, homeownership can also provide a sense of financial stability and control over your housing expenses. Unlike renting, where monthly payments can vary and are subject to the whims of landlords and market conditions, homeownership typically involves fixed monthly mortgage payments that remain constant throughout the life of the loan.

The advantages of homeownership for building net worth are clear. By owning a home, you can build equity, take advantage of tax benefits, and gain a sense of control over your housing expenses. These advantages can ultimately help you achieve your long-term financial goals and build substantial wealth over time.

One reason a wealth gap exists between renters and homeowners is because when you’re a homeowner, your equity grows as your home appreciates in value and you make your mortgage payment each month. When you own a home, your monthly mortgage payment acts like a form of forced savings, which eventually pays off when you decide to sell. As a renter, you’ll never see a financial return on the money you pay out in rent every month. Ksenia Potapov, Economist at First American, explains it like this:

“Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments . . .”

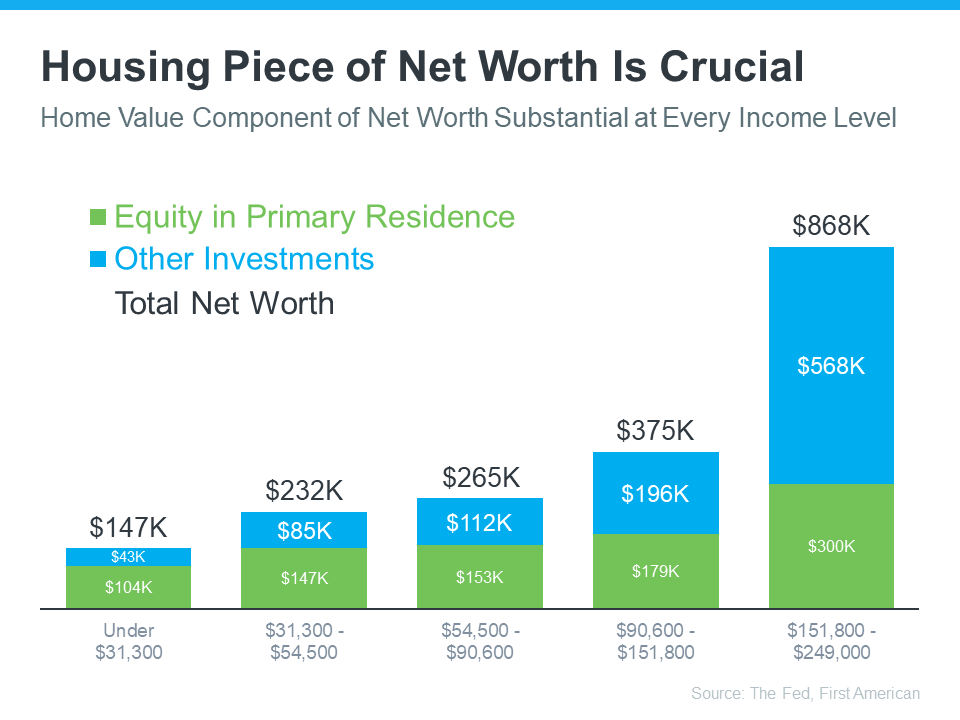

The Largest Part of Most Homeowner Net Worth Is Their Equity

Home equity does more to build the average household’s wealth than anything else. According to data from First American and the Federal Reserve, this holds true across different income levels (see graph below):

The blue segment in each bar represents how much of a homeowner’s net worth comes from their home equity. Based on this data, it’s clear no matter what your income level is, owning a home can really boost your wealth. Nicole Bachaud, Senior Economist at Zillow, shares:

“The biggest asset most people are ever going to own is a home. Homeownership is really that financial key that helps unlock stability and wealth preservation across generations.”

The Connection Between Net Worth and Homeownership

Owning a home is not only a source of pride and accomplishment, but it can also significantly contribute to your overall net worth and financial standing. There is a direct relationship between homeownership and net worth, as your home equity represents a tangible and potentially significant asset. The longer you own your home, the more you are likely to benefit from appreciation in value and the growth of your equity. This means that homeownership can be a valuable tool for building long-term wealth and financial stability.

By consistently making mortgage payments, you are not only building equity but also establishing a history of responsible financial behavior. Lenders and financial institutions view homeownership positively, as it indicates stability and reliability in your financial management. Additionally, owning a home can provide tax benefits, which can further increase your overall net worth.

If you are looking to increase your net worth through homeownership, it is important to work with experienced professionals who can help you navigate the process. At 719 Lending in Colorado Springs, we specialize in assisting individuals in unlocking the full potential of homeownership net worth. Our team of expert loan officers can provide guidance on everything from finding the right mortgage product to understanding the tax benefits of homeownership. Contact us today to learn how we can help you achieve your homeownership and net worth goals.

Unlocking Homeownership Net Worth with 719 Lending

If you’re looking to unlock the potential of homeownership net worth in Colorado Springs, 719 Lending can help make it happen. Our experienced team is dedicated to providing you with the services and expertise you need to achieve your homeownership goals and build your net worth.

At 719 Lending, we understand that buying a home can be a complex process, which is why we guide you through every step of the journey. We provide personalized solutions to help you choose the right mortgage for your needs and financial situation, and we work hard to ensure that the process is as seamless and stress-free as possible.

By choosing to work with 719 Lending, you can take advantage of our wide range of mortgage options, including conventional loans, FHA loans, VA loans, and more. We also offer down payment assistance programs to help make homeownership more accessible and affordable for those who might not otherwise qualify.

Ultimately, our goal is to help you achieve your dream of homeownership while building your net worth over time. With our help, you can find the right mortgage solution for your unique needs and start building equity in your home from day one.

Why Choose 719 Lending?

When it comes to unlocking the potential of homeownership net worth, 719 Lending stands out for several key reasons:

- Expertise: Our team has years of experience in the mortgage industry, and we have the knowledge and skills needed to guide you through the process of buying a home.

- Customized Solutions: We understand that each individual’s financial situation is unique, and we provide personalized mortgage solutions that are tailored to your needs.

- Wide Range of Mortgage Options: Whether you’re a first-time homebuyer or looking to refinance, we offer a variety of mortgage options to choose from.

- Down Payment Assistance Programs: We believe that everyone should have access to the benefits of homeownership, which is why we offer down payment assistance programs to help make it more accessible and affordable.

Overall, 719 Lending is committed to helping individuals throughout Colorado Springs achieve their homeownership and net worth goals. Contact us today to learn more about how we can help you unlock the potential of homeownership net worth.

Strategies for Maximizing Homeownership Net Worth

If you’re a homeowner looking to maximize your net worth, there are several strategies you can employ to boost your financial standing. Here are some tips:

1. Make additional mortgage payments

By making additional payments towards your mortgage, you can reduce the amount of interest owed and pay off your loan sooner. This translates to more equity in your home and a higher net worth overall.

2. Leverage home equity for investment purposes

If you have significant equity in your home, consider using it to invest in other assets, such as real estate or stocks. This can provide additional sources of income and diversify your portfolio.

3. Take advantage of tax benefits related to homeownership

There are numerous tax benefits available to homeowners, such as deductions for mortgage interest, property taxes, and home office expenses. Be sure to consult with a tax professional to fully understand and take advantage of these benefits.

By implementing these strategies, you can work towards maximizing your homeownership net worth and building long-term financial stability.

Benefits of Long-Term Homeownership

Long-term homeownership comes with numerous benefits that can contribute to overall financial growth and stability. One of the most significant advantages is the potential for substantial home equity accumulation. By consistently paying off your mortgage over an extended period, you can build equity and increase your net worth.

Moreover, owning a home over the long-term provides an opportunity to invest in your property and make upgrades that could potentially increase its value. By doing so, you can benefit from appreciation in the real estate market, which can translate to even further net worth growth.

Additionally, long-term homeownership provides a sense of stability and security, allowing you to establish roots in your community and potentially benefit from the upsides of burgeoning neighborhoods over time. Furthermore, owning a home can provide a significant tax benefit through deductions for mortgage interest and property tax payments.

In short, long-term homeownership can bring about a variety of advantages that contribute to overall financial well-being and long-term net worth growth.

Homeownership Net Worth and Retirement Planning

Planning for retirement can be a daunting task, but owning a home can provide a valuable asset in securing financial stability during your later years.

As you make mortgage payments and build home equity, your net worth increases, providing a foundation for your retirement savings plan. Consider the potential for downsizing to a smaller home or using home equity to supplement retirement income.

Additionally, the potential tax benefits of homeownership can also contribute to your retirement savings. Consult with a financial advisor to develop a retirement plan that takes advantage of your homeownership net worth.

Retirement Planning Checklist:

- Maximize your 401(k) contributions to take advantage of employer matching

- Consider opening an IRA or Roth IRA account for additional retirement savings

- Explore ways to tap into your homeownership net worth for retirement income, such as downsizing or using home equity to supplement expenses

- Work with a financial advisor to develop a comprehensive retirement plan that accounts for your homeownership net worth

By incorporating homeownership net worth into your retirement planning, you can build long-term financial security while enjoying the benefits of owning a home.

Overcoming Barriers to Homeownership

While owning a home is a dream for many, there are often barriers that can make achieving this goal seem daunting. However, with determination and the right strategies, you can overcome these obstacles and make homeownership a reality. Here are some of the most common barriers to homeownership and ways to overcome them.

Saving for a Down Payment

One of the biggest challenges to homeownership is saving for a down payment. But don’t despair – there are ways to make this more achievable. Consider setting up a savings plan and automate regular contributions into it. You can also explore down payment assistance programs that may be available to you, such as grants or loans.

Improving Credit Scores

Another hurdle to homeownership is having a low credit score. Lenders are often more hesitant to approve loans for those with poor credit history. However, there are steps you can take to improve your credit score, such as paying your bills on time, reducing debt, and disputing any errors on your credit report. Additionally, 719 Lending can work with you to identify strategies for improving your credit score.

Navigating the Mortgage Application Process

The mortgage application process can be overwhelming, but it doesn’t have to be. Reach out to a qualified lender like 719 Lending for guidance on what to expect and how to approach the process. Make sure to gather all necessary documentation, such as proof of income and tax returns, and be prepared to answer questions about your employment history and creditworthiness.

Overcoming these barriers to homeownership may require patience, perseverance, and support, but it is possible. Don’t be discouraged if it takes time and effort – the benefits of homeownership, from building net worth to financial stability, make it worthwhile.

Conclusion

Congratulations on taking the first step towards unlocking the potential of homeownership net worth! As you have learned throughout this article, owning a home can be an effective means of building wealth and achieving financial stability. By increasing your net worth through homeownership, you can open up a world of new opportunities and secure your financial future.

Remember, maximizing your homeownership net worth requires careful planning and strategizing. With the help of 719 Lending, you can take advantage of expert advice and guidance to achieve your homeownership goals and boost your net worth. Whether you’re a first-time homebuyer or a seasoned homeowner, the benefits of homeownership net worth are within reach.

Thank you for reading, and best of luck on your journey towards homeownership net worth!

FAQ

What is homeownership net worth?

Homeownership net worth refers to the value of a homeowner’s assets minus their liabilities, including the equity they have in their home. It represents the financial value and wealth accumulated through owning a home.

How does homeownership impact net worth?

Homeownership can have a significant impact on net worth. As homeowners make mortgage payments, their home equity increases, which in turn contributes to their net worth. Moreover, the appreciation of real estate over time can further boost net worth.

Can homeownership help in building wealth?

Yes, homeownership can be a valuable means of building wealth. Homeowners have the opportunity to accumulate home equity over time, which can serve as a valuable asset. Real estate generally appreciates in value, allowing homeowners to increase their net worth.

How does home equity contribute to net worth growth?

Home equity is the difference between the market value of a home and the amount still owed on the mortgage. As homeowners make mortgage payments and their home’s value increases, their equity grows. This increase in home equity directly contributes to net worth growth.

What are the advantages of homeownership for building net worth?

Homeownership offers several advantages for building net worth. Homeowners can build equity through mortgage payments and home appreciation. They can also leverage their home equity for investment purposes or use it as collateral for loans. Additionally, homeownership allows for potential tax benefits.

How does homeownership impact financial stability?

Homeownership can provide financial stability in several ways. Fixed monthly mortgage payments provide predictability and stability in housing expenses. Additionally, potential tax benefits can free up more disposable income. Homeownership also provides a sense of control over housing expenses, reducing the risk of sudden increases in rent.

How can 719 Lending help in unlocking homeownership net worth?

719 Lending is a trusted lending institution in Colorado Springs that specializes in assisting individuals with their homeownership journey. They provide expert advice, offer a variety of loan options, and guide borrowers through the mortgage process, helping them unlock the potential of homeownership net worth.

What are some strategies for maximizing homeownership net worth?

There are several strategies homeowners can employ to maximize their homeownership net worth. These include making additional mortgage payments to build equity faster, leveraging home equity for investment purposes, and taking advantage of tax benefits related to homeownership. It is important to consult with a financial advisor or mortgage specialist to determine the best strategy for individual circumstances.

What are the benefits of long-term homeownership for net worth growth?

Long-term homeownership provides an opportunity for substantial net worth growth. Over time, homeowners can build significant home equity, allowing them to tap into this wealth for future financial ventures or in retirement. Additionally, long-term homeownership offers stability and peace of mind, knowing that housing expenses are fixed and that the value of the home may appreciate.

How does homeownership net worth factor into retirement planning?

Homeownership net worth can play a crucial role in retirement planning. The equity accumulated in a home can be used to supplement retirement income or even downsized to provide a nest egg. By paying off the mortgage before retirement, homeowners can reduce housing expenses and increase their financial security during their retirement years.

What are some common barriers to homeownership, and how can they be overcome?

Common barriers to homeownership include saving for a down payment, having a low credit score, and navigating the mortgage application process. These barriers can be overcome by establishing a savings plan, improving credit scores through responsible financial behavior, and working with reputable lenders and mortgage specialists who can guide borrowers through the process.