VA Loan Entitlement Options for Military Couples Are you and your spouse both serving—or have…

Key Tips for VA Disability Benefits: Military Disability Compensation

What You’ll Learn: In this post, we’ll explore how military disability compensation works, why it matters for Colorado Springs homebuyers, and how these benefits can affect your mortgage journey. We’ll also touch on where to find updated rate tables, what these payments mean for your monthly finances, and how 719 Lending can help you purchase or refinance a home in Colorado.

Understanding VA Disability Compensation

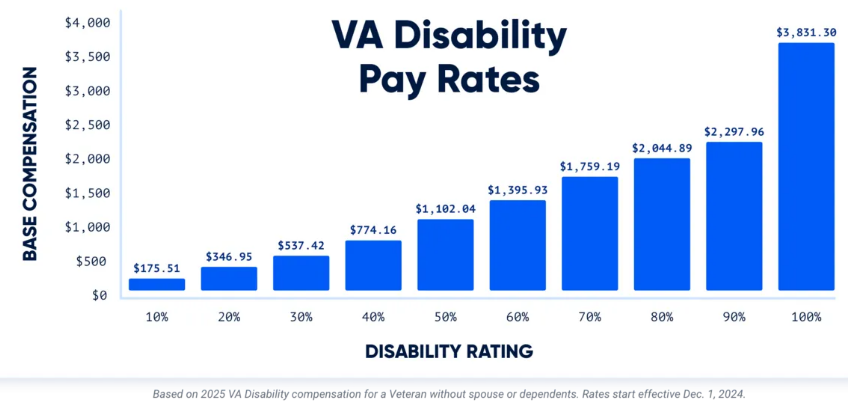

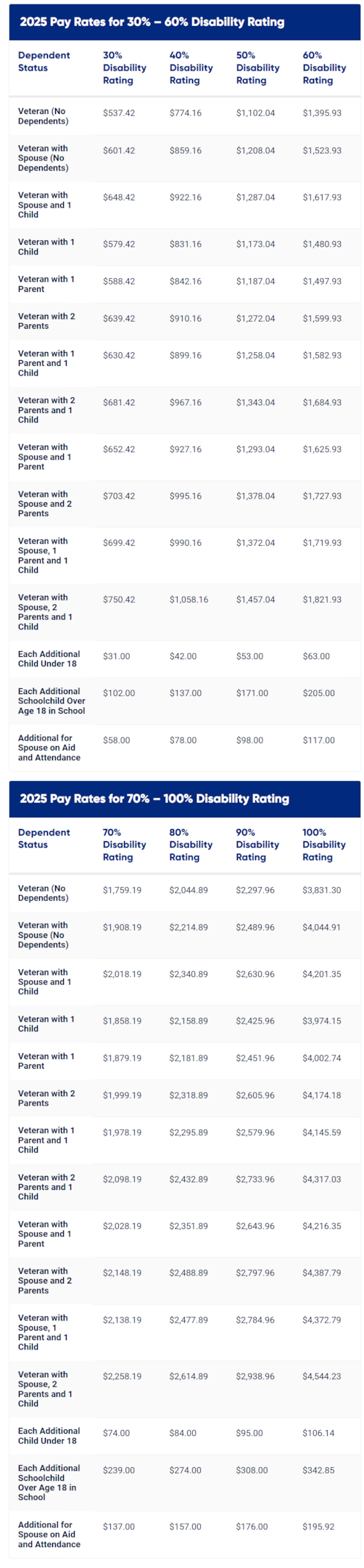

Military disability compensation is a monthly tax-free payment the U.S. Department of Veterans Affairs (VA) provides to eligible veterans. These disability benefits offer crucial financial and support resources for individuals with disabilities, particularly veterans. Each year, these payment rates may change to account for the cost of living. According to the VA’s official rate tables, the compensation amount depends on the severity of a service-connected disability and the established disability ratings.

Here’s what you need to know next:These benefits are crucial if you’re planning to buy Colorado Springs real estate because consistent monthly income may strengthen your mortgage application. Whether you’re a first-time homebuyer or a current homeowner in Colorado, disability compensation can help with monthly mortgage payments or other household expenses.

Post-traumatic stress disorder (PTSD) is a significant example of a service-connected disability that may require additional documentation to support a disability claim.

Eligibility and Requirements:To qualify for VA disability compensation, veterans must have service connected disabilities, which are injuries or diseases that occurred during or were aggravated by military service. Additionally, benefits are available for surviving spouses under Dependency and Indemnity Compensation (DIC), providing financial support to spouses, children, or parents of servicemembers who died during service or due to service-connected disabilities.

Eligibility and Requirements

To be eligible for VA disability compensation, veterans must meet certain requirements. Here are the key eligibility criteria:

- Service Connection: The veteran’s disability must be service-connected, meaning it was incurred or aggravated during active military service.

- Discharge Status: The veteran must have been discharged from the military under conditions other than dishonorable.

- Medical Evidence: The veteran must provide medical evidence to support their disability claim, including private medical records and service treatment records.

- Disability Rating: The veteran must have a disability rating assigned by the VA, which determines the level of compensation they are eligible for.

- Application: The veteran must apply for disability compensation through the VA, either online, by phone, or in person.

In addition to these requirements, the VA also considers the following factors when determining eligibility:

- Nature and Extent of Disability: The VA evaluates the severity and impact of the veteran’s disability on their daily life and ability to work.

- Military Service History: The VA reviews the veteran’s military service history to determine if their disability is related to their service.

- Medical History: The VA examines the veteran’s medical history to determine if their disability is related to their service-connected condition.

Veterans who meet these eligibility criteria may be eligible for disability compensation, which can provide a monthly tax-free payment to help offset the costs of their disability. The VA also offers additional benefits, such as Dependency and Indemnity Compensation (DIC) for surviving spouses and Special Monthly Compensation (SMC) for veterans with severe disabilities.

It’s important to note that the VA uses a combined disability rating system to determine the overall level of disability compensation a veteran is eligible for. This system takes into account multiple disabilities and assigns a single rating that reflects the veteran’s overall level of disability.

If you’re a veteran with a service-connected disability, it’s essential to understand the eligibility requirements and application process for VA disability compensation. You can start by visiting the VA’s website or contacting a Veterans Service Organization (VSO) for guidance and support.

Why It Matters for Colorado Homebuyers

1. Boosted Financial Stability

Having a reliable monthly source of income from military disability compensation can lower your debt-to-income ratio. That ratio is a common factor mortgage professionals review when deciding on loan approvals. With more income, you may qualify for a larger mortgage loan or enjoy more manageable monthly payments.

2. Potentially Lower Funding Fees

If you receive VA disability compensation, you might qualify for a reduced (or fully waived) VA funding fee when taking out a VA loan. This benefit can save you thousands of dollars over the life of your mortgage. For more details on how VA loans work, check official resources from the Consumer Financial Protection Bureau (CFPB).

3. Better Credit Position

Disability compensation can also help you stay on top of bills. Paying your bills on time supports a healthy credit score, which in turn improves your interest rate prospects. Whether you choose a VA loan or another mortgage product, a stable credit profile is key.

How to Check the Current Disability Rating Tables

Each year, the rates for military disability compensation are updated. You can find comprehensive rate tables on the U.S. Department of Veterans Affairs website. These tables break down monthly payment amounts based on your disability rating and the number of dependents you have.

If you want to see how these tables influence your monthly budget, consider using a spreadsheet or a financial planning tool. That way, you’ll quickly see how much you have available for housing costs in Colorado Springs or elsewhere in the state of Colorado.

Tips for Using Disability Compensation Toward a Mortgage

- Get Pre-Approved Early

Talk to a loan officer or mortgage lender at 719 Lending. A pre-approval gives you a clearer picture of your budget before you start shopping for Colorado Springs real estate. - Work With a Mortgage Professional

A mortgage broker who understands VA loans can guide you through the funding fee waivers, down payment rules, and other nuances tied to disability compensation. - Check Out Local Resources

Colorado offers various programs for veterans. Research county or state-level assistance that might help with closing costs or property taxes. The U.S. Department of Housing and Urban Development (HUD) also has resources for homebuying assistance. - Build a Financial Cushion

If your disability rating changes, your monthly compensation may go up or down. Plan a buffer in your mortgage payment strategy so you’re prepared for any future adjustments.

Steps to Incorporate Your Disability Compensation in the Homebuying Process

- Calculate Your Monthly Budget

Include your compensation payments as part of your total income. This can raise your purchasing power in Colorado. - Review Your Credit

Check your credit report for errors, and address any issues. A stronger credit profile can lead to a better interest rate. - Gather Documentation

Collect pay stubs, disability award letters, and other proof of consistent income. Lenders often need these documents to finalize your loan. - Consult With 719 Lending

A local mortgage professional in Colorado Springs can explain every stage of the loan process. Check out our Home Loan Options to see what best fits your situation. - Stay Informed

Rate tables, cost-of-living adjustments, and VA loan guidelines can change. Set up alerts or bookmark the VA’s disability compensation website to stay updated.

FAQ: Veterans Disability Benefits and Home Loans

Q1: Do I need a specific disability rating to apply for a VA loan?No specific rating is required to apply for a VA loan, but your compensation amount can help you qualify or waive the VA funding fee. Check with 719 Lending for personalized guidance.

Q2: Can I use my disability compensation to qualify for a larger mortgage?Yes. Lenders consider your total income when deciding on the size of the loan you can handle. Disability compensation can boost your income, helping you qualify for a higher mortgage amount.

Q3: What if my disability rating changes after I close on my mortgage?If your rating changes, your monthly payments could go up or down. This does not automatically change your mortgage, but it can impact your monthly finances. Keep open communication with your loan officer if you have concerns.

Q4: Why is the VA notification letter important in the claims process?The VA notification letter is a critical document in the claims process as it formally informs veterans about their claim’s status and the decisions made by the VA. Veterans have one year from the date of this notification to appeal the claims decision, making it essential for understanding their disability rating and its impact on benefits, including home loans.

While this article provides a thorough overview of VA disability compensation and how it can impact your homebuying journey, please remember these important clarifications:

- Regulations and Rates Can Change

VA disability rates, qualification standards, and mortgage guidelines may be updated periodically. Always verify the latest information on the VA’s official website and consult with 719 Lending or another qualified mortgage professional for the most accurate and personalized advice. - Service Connection is Critical

To receive disability compensation, your condition must be determined by the VA to be service-connected. The assigned disability rating directly influences the amount of monthly tax-free compensation you receive. - No Guaranteed Loan Amount

While disability income can strengthen your mortgage application or reduce VA loan fees, each lender has unique underwriting criteria. Your total financial profile, including credit and debt-to-income ratio, also factors into the final loan approval and amount. - Appeals & Notification Letters

Veterans have the right to appeal claims decisions within one year of the notification date. Keep all official VA documents, including notification letters, as they outline crucial details that may affect your benefits and mortgage options. - Seek Professional Guidance

This content is informational only and should not replace professional advice. Consult with a mortgage officer at 719 Lending if you have questions about your specific situation. For any legal or tax-related concerns, consider speaking with an attorney or financial advisor.

By staying informed, keeping organized documentation, and working closely with knowledgeable professionals, you can make the most of your VA disability benefits and secure a home in Colorado Springs or anywhere in Colorado. If you’re ready to learn more about your mortgage options, reach out to 719 Lending for expert guidance and support.

Your Next Step

If you’re a veteran or service member looking to buy a home in Colorado Springs, your military disability compensation might give you the edge you need. Contact 719 Lending to discuss your mortgage options today. Our friendly and expert loan officers will help you find the best path to homeownership in Colorado, ensuring you make the most of your VA benefits.

(Disclaimer: This article is for informational purposes only and is not financial or legal advice. For details on current compensation rates and benefits, consult the VA’s official resources or speak with a qualified mortgage professional.)