Why You Should Opt Out of Prescreened Credit Offers https://www.optoutprescreen.com/ When you apply for a…

one-time close vs two-time close construction loan

One Time Close vs Two Time Close Construction Loan: Which is Best for You?

When planning to build a home, understanding the right construction loan for your project is crucial. The main decision often comes down to choosing between a One Time Close vs Two Time Close Construction Loan. This guide will help you understand the key differences, advantages, and drawbacks of each option to determine which is best for your needs.

Key Takeaways

- Construction loans are specifically designed for building projects, with funds disbursed in stages as construction milestones are met, often requiring higher credit scores and lower debt-to-income ratios.

- A One-Time Close Construction Loan combines interim and permanent financing into a single transaction, reducing paperwork and closing costs, while a Two-Time Close Construction Loan requires two separate approvals but offers greater flexibility during construction.

- Choosing the right loan type depends on individual financial situations, project specifics, and the complexity of construction, underscoring the importance of consulting with mortgage loan officers for tailored advice.

Understanding Construction Loans

Construction loans are a unique type of financing designed specifically for building projects. Unlike traditional mortgages, which provide a lump sum to purchase a pre-existing home, construction loans are disbursed in stages as the project progresses. Grasping the details of these loans is crucial since their requirements can greatly affect your finances.

Choosing the right construction loan involves knowing your financial situation, project specifics, and available options. Here’s an overview of what a construction loan includes and the important elements to consider.

What is a Construction Loan?

A construction loan is a short-term loan specifically designed to cover the costs associated with building a home.

These loans typically last about a year or less and are intended to finance the construction phase of the project.

The primary purpose of a construction loan is to cover expenses such as:

- land

- labor

- materials

- permits

Borrowers only pay interest on the amount of money that is used during construction, making these loans distinct from traditional mortgages.

Funds from a construction loan are released in phases, known as “draws,” as the project hits predetermined milestones. This method ensures the project stays on track and within budget. However, construction loans often come with higher interest rates and stricter qualifying criteria, including a higher credit score and lower debt-to-income ratio, compared to regular mortgages.

Key Components of Construction Loans

One of the critical components of a construction loan is the higher interest rate, which reflects the increased risk for lenders financing construction projects. This higher rate compensates for the uncertainties and potential setbacks that can occur during the building process. Additionally, inspections are required at the end of each funding draw to ensure that the work completed meets the lender’s standards, which is crucial for maintaining the project’s progress and quality.

Inspections are crucial for determining the disbursement schedule and maintaining project progress. Knowing these elements helps borrowers manage the complexities of construction loans, preparing them for both financial and procedural aspects.

One-Time Close Construction Loan

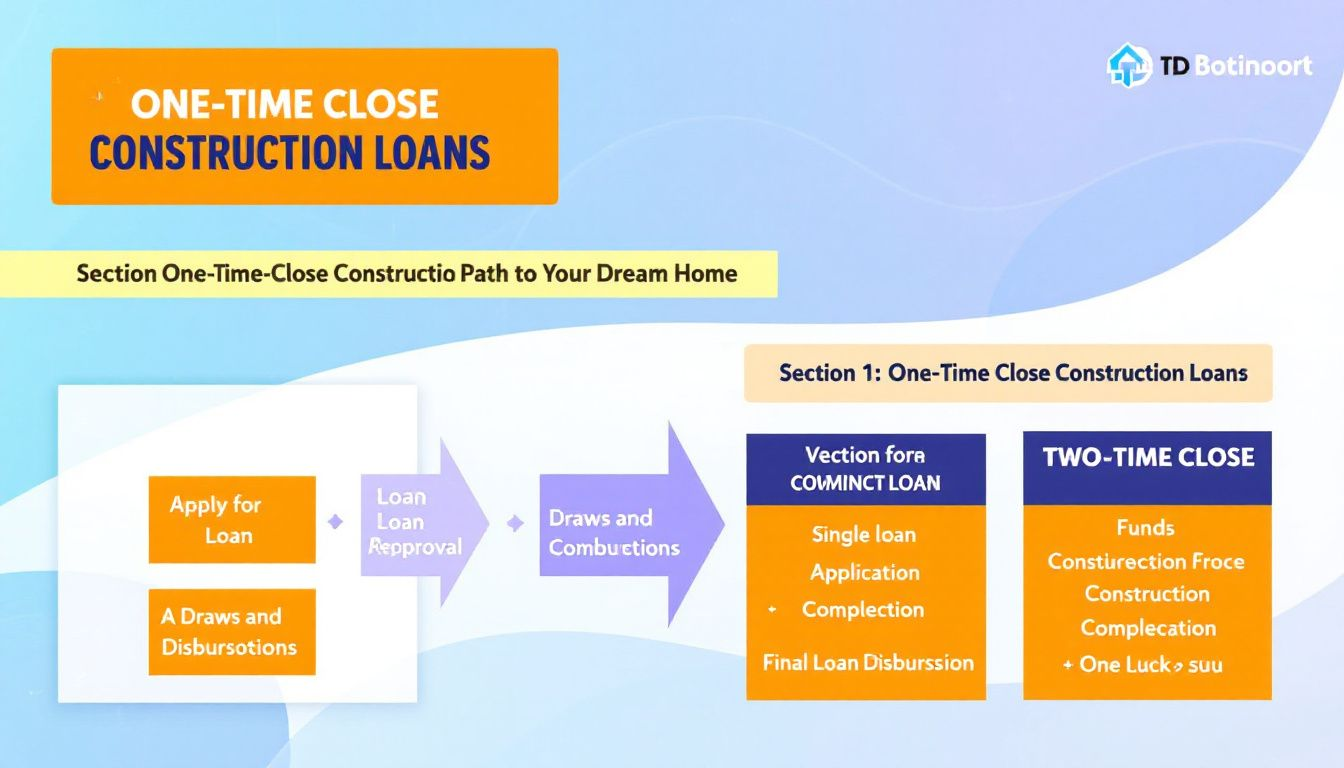

A One-Time Close Construction Loan, also known as a construction to permanent loan, is an increasingly popular financing option for home builders. This type of loan combines both the interim construction financing and the permanent mortgage into a single loan with one closing.

This streamlined process can significantly simplify the financing for borrowers, allowing them to secure both construction and permanent financing in a single transaction. The growing popularity of One-Time Close Construction Loans is driven by market dynamics such as secondary mortgage market changes and housing inventory shortages.

How One-Time Close Construction Loans Work

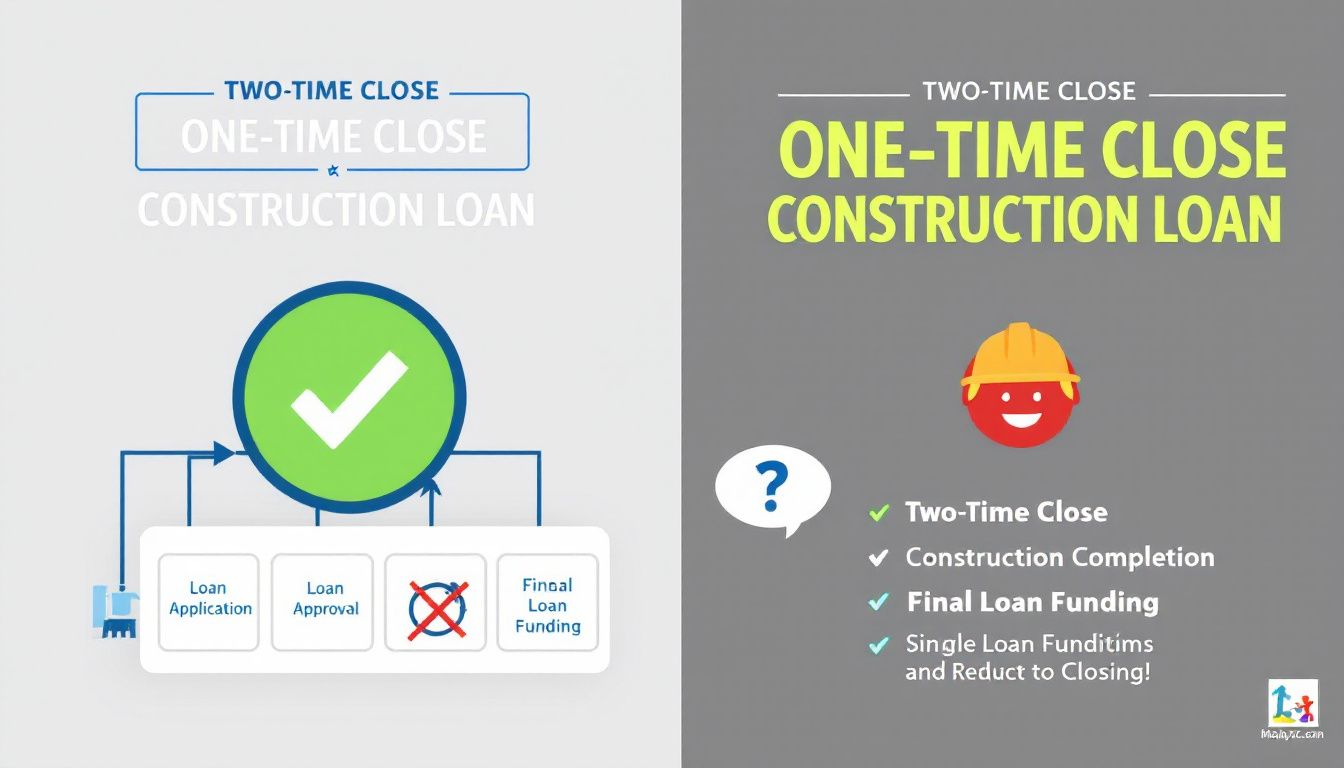

A One-Time Close Construction Loan merges interim construction financing and the permanent mortgage into one transaction. Borrowers only need to undergo the loan approval and closing process once, simplifying overall financing. After the closing, the loan transitions to a traditional mortgage once the construction is completed. The funds from the construction loan are released in stages, or “draws,” as specific phases of the construction are completed.

While this loan type offers significant convenience, it also requires detailed construction plans and budgets upfront, as the lender needs to assess both the construction and permanent financing at the same time. This can make qualifying for a One-Time Close loan more complex due to the stringent requirements.

Advantages of One-Time Close Construction Loans

One of the primary advantages of One-Time Close Construction Loans is the reduced paperwork and closing costs, as borrowers only need to go through the closing process once. This not only saves time but also minimizes the administrative burden associated with multiple loan applications. Additionally, by combining the construction and permanent loan qualifications into a single process, borrowers face less risk of not qualifying for the permanent loan after construction is completed.

Additionally, single close loans usually feature fixed interest rates, offering stability and predictability in monthly payments. This can be more advantageous than the adjustable-rate structure often found in Two-Time Close loans, especially when considering one loan.

Potential Drawbacks of One-Time Close Construction Loans

Despite their benefits, One-Time Close Construction Loans have potential drawbacks that borrowers need to consider. A key challenge is the higher upfront costs, which can be disadvantageous for those with limited initial funds. Moreover, these loans offer less flexibility in adjusting terms during construction compared to other loan types.

Overall, while One-Time Close Construction Loans provide many advantages, the potential drawbacks of higher upfront costs and reduced flexibility are crucial considerations for prospective borrowers.

Two-Time Close Construction Loan

A Two-Time Close Construction Loan, also known as a standalone construction loan, is another popular financing option for home builders. This loan structure involves securing financing in two stages: an interim loan for the construction phase and a separate permanent mortgage after the construction is completed.

How Two-Time Close Construction Loans Work

With a Two-Time Close Construction Loan, borrowers must close twice—once for the interim construction loan and once for the permanent mortgage. This means that approval for multiple loans is required, which can add complexity to the process. Keeping the permanent loan separate from the construction loan offers flexibility in choosing loan options and potentially better rates.

The interim loan covers the costs incurred during construction, and once the construction is completed, the loan transitions to a permanent mortgage through a second closing. This allows borrowers to have more control and flexibility during the construction phase.

Benefits of Two-Time Close Construction Loans

One of the key benefits of Two-Time Close Construction Loans is the greater flexibility they offer during the construction phase. Borrowers can make adjustments to their plans without affecting the permanent financing, which can be crucial for accommodating changes that may arise during the build process. Additionally, modifications can often be added to the end loan, providing even more flexibility.

This flexibility can be particularly beneficial for complex projects that may require changes or adjustments as construction progresses.

Challenges with Two-Time Close Construction Loans

However, Two-Time Close Construction Loans come with their own set of challenges. One of the main drawbacks is the need to pay closing costs twice, which can result in higher overall expenses compared to One-Time Close loans. Additionally, the approval process can be more complex due to the need for two separate applications and potential qualification issues at each stage.

Re-qualifying for permanent financing after construction adds complexity and risk, complicating the overall financing process and increasing uncertainty for the borrower.

Comparing One-Time Close vs Two-Time Close Construction Loans

Choosing between a One-Time Close and a Two-Time Close Construction Loan depends on various factors, including cost, flexibility, and the approval process. Each loan type has its own set of advantages and disadvantages that need to be carefully considered.

Cost Comparison

One-time close construction loans generally have reduced closing costs, saving both time and money. Borrowers can save money by reducing overall interest payments, specifically by only paying interest on the funds used during the construction phase. In comparison, Two-Time Close Construction Loans can incur higher overall costs due to the necessity of paying closing costs twice for interim and permanent financing stages.

Several factors influence the interest rates for construction loans, impacting the overall expense. Comparing mortgage rates after construction can lead to cost savings by securing more competitive interest rates during the transition to permanent financing.

Flexibility and Convenience

One-time close loans provide more flexibility for borrowers as they only need to manage one set of documents. However, a potential downside is that it limits options if interest rates drop or if loan terms are changed after construction. Changes during construction with a One-Time Close loan often result in out-of-pocket expenses for the borrower.

Conversely, Two-Time Close loans allow for greater flexibility in accommodating changes during construction without affecting the permanent financing.

Qualification and Approval Process

To qualify for a construction loan, borrowers typically need a credit score of at least 680 and a low debt-to-income ratio. The approval process for One-Time Close loans can be more stringent as lenders need to assess both construction and permanent financing upfront.

On the other hand, the requirement for two separate approvals in two loans can complicate the financing process and potentially cause delays if the borrower faces difficulties securing the second mortgage.

Choosing the Right Loan for Your Needs

Determining the right construction loan involves evaluating individual financial situations, project requirements, and consulting professionals for tailored advice. The choice between One-Time and Two-Time Close Construction Loans often hinges on individual circumstances and preferences.

Assessing Your Financial Situation

Lenders typically require a minimum qualifying credit score of 680 for construction loans, making it crucial to evaluate your credit health before applying. Construction loans often have stricter qualifying criteria than traditional mortgages due to their short-term nature. A debt-to-income (DTI) ratio of less than 43% is generally required by lenders, highlighting the need for careful assessment of your income and expenses.

Furthermore, a down payment ranging from 20% to 30% is typically required, reflecting the higher risk associated with these loans.

Considering Your Construction Project

The complexity of a construction project can significantly influence the type of loan needed, impacting factors like loan terms and interest rates. Complex projects may require more specialized financing options compared to simpler projects.

Understanding the specifics of your construction project will help in selecting the most suitable loan type.

Consulting with Mortgage Loan Officers

A loan advisor can offer personalized recommendations based on your financial situation and construction plans. Connecting with a mortgage lender licensed in your area is key to understanding your financing options and their implications.

By following expert advice, you can streamline the loan application process and reduce potential pitfalls.

Summary

Summarize the key points discussed in the blog post and provide concluding thoughts that inspire readers to make informed decisions. Highlight the importance of choosing the right construction loan based on their individual needs and project requirements.

Frequently Asked Questions

What is the main difference between One-Time Close and Two-Time Close Construction Loans?

The main difference between One-Time Close and Two-Time Close Construction Loans is that the former consolidates construction and permanent financing into a single loan with one closing, whereas the latter involves two separate loans and requires two distinct closings. This can affect the overall timeline and costs associated with your construction financing.

Are One-Time Close Construction Loans more expensive upfront?

Yes, One-Time Close Construction Loans can have higher upfront costs because they combine both construction and permanent financing into a single loan.

Which loan type offers more flexibility during construction?

Two-Time Close Construction Loans provide greater flexibility during the construction phase, enabling borrowers to make adjustments without impacting the permanent financing.

What credit score is typically required for a construction loan?

A credit score of at least 680 is generally required for a construction loan. Meeting this threshold will enhance your chances of securing the financing needed for your project.

Can I change my loan terms after construction with a One-Time Close loan?

Yes, you can change your loan terms after construction with a One-Time Close loan, but be aware that such changes may incur additional out-of-pocket expenses.