Why You Should Opt Out of Prescreened Credit Offers https://www.optoutprescreen.com/ When you apply for a…

VA Home Loan Mortgage: Pros & Cons

Pros and Cons of a VA Home Loan Mortgage

Navigating the path to home ownership is like embarking on an inspiring journey, much like Kevin’s own triumphant story.

He recently discovered how a VA home loan mortgage could accelerate his dream of owning a home in Colorado Springs, with the guidance of 719 Lending experts lighting the way.

Understanding VA Home Loan Mortgages

VA home loan mortgages offer veterans, service members, and surviving spouses a unique opportunity to become homeowners with favorable terms.

First and foremost, one of the distinguishing features of a VA home loan mortgage is the ability to purchase a property without any down payment, eliminating a significant barrier many face when buying a home. Furthermore, these loans typically have more flexible credit requirements, making it easier for individuals to qualify. Lenders also streamline the process by minimizing additional costs like private mortgage insurance, allowing borrowers to save more initially.

Additionally, these loans provide a competitive interest rate in comparison to conventional loans, which can lead to considerable savings over time. By working with a local mortgage professional, such as those at 719 Lending, veterans can harness these benefits to secure their financial future and invest in Colorado Springs real estate.

Moreover, VA home loan mortgages are backed by the U.S. Department of Veterans Affairs, which offers support and guarantees lenders against a portion of any loss they may incur. This security encourages lenders to offer more favorable terms, ensuring that military families can enjoy homeownership opportunities tailored to their needs and aspirations. With this understanding, prospective buyers can approach their home buying journey with confidence and clarity.

Benefits of VA Home Loans

VA home loans boast zero-down-payment options, easing veterans’ path to homeownership and financial independence.

In fact, eligible service members and veterans often qualify for attractive interest rates, enabling significant long-term savings. With the guidance of experts at 719 Lending, navigating these advantages becomes seamless for Colorado Springs homeowners.

Moreover, “no-private-mortgage-insurance” and “no-prepayment-penalty” clauses grant extraordinary flexibility in financial commitments.

VA Loan Pros and Cons at a Glance

| Pro | Con |

|---|---|

| No down payment | VA funding fee |

| No PMI | VA funding fee increases after first use |

| Higher allowable DTI | Loan could exceed market value |

| Credit flexibility | Only for primary residences |

| Better than average interest rates | Sellers and agents may not be familiar |

| Multiple refinance options | – |

| No prepayment penalty | – |

| VA loans are assumable | – |

This table provides a high-level overview of the pros and cons. Below the table is a full explanation for each pro or con.

No Down Payment Requirement

One of the standout benefits of a VA home loan mortgage is the extraordinary no down payment requirement.

Veterans can purchase a home without upfront expenses, easing the financial burden significantly.

Imagine the doors this opens—purchasing a new home in Colorado Springs without needing savings for a down payment can bring the dream of ownership into immediate reach. This is especially beneficial for families accustomed to moving frequently.

It’s a significant advantage that can dramatically alter the home-buying landscape, allowing qualified buyers to enter the market sooner. With expert guidance from 719 Lending, this feature can be effortlessly leveraged to secure a desirable home.

How VA Loans Compare

All mortgage types have their own distinct advantages and drawbacks. But when you stack them side by side, VA loans rise above for many Veteran and military homebuyers.

Here’s a quick look at how VA loans compare to both conventional mortgages and FHA loans, which are also government-backed.

| VA Loans | Conventional Loans | FHA Loans |

|---|---|---|

| 0% Down (for qualified borrowers)VA loans are among the last no down payment loans on the market. |

Up to 20% DownDown payments as low as 3% are out there, but higher down payments are more common. | 3.5% DownFHA loans require a minimum down payment. |

| No PMIEven with the 0% down payment benefit, VA loans don’t require private mortgage insurance. | PMI RequiredConventional loans usually require private mortgage insurance unless you make a 20% down payment. | Upfront + Annual MIPFHA buyers pay both an upfront and annual mortgage insurance premiums. |

| Competitive Interest RatesVA loans have the lowest average rate on the market, according to Optimal Blue data. | Low Rates at a CostBuyers often need top-tier credit scores in order to tap into the best conventional mortgage rates. | Middle of the Road RatesFHA loans are typically lower on average than conventional rates but higher than VA loan rates, according to Optimal Blue data. |

| Lowest Origination CostsVA loans had the lowest average origination cost last year, according to HMDA data. | Middle of the Road CostsAverage conventional loan origination charges were 22% higher than VA charges last year, according to HMDA data. | Highest Origination CostsAverage FHA loan origination charges were 27% higher than VA charges last year, according to HMDA data. |

| Easier to QualifyThe VA loan is a hard-earned job benefit created to expand access to homeownership for Veterans and service members. More flexible and forgiving credit underwriting guidelines are a hallmark of the program. | Standard ProceduresConventional mortgage options often require higher credit scores and down payment requirements than VA loans, along with stricter underwriting guidelines in some cases. | Qualifying is Easier, TooFHA loans were created to help lower and middle-income consumers become homeowners and offer some flexible underwriting guidelines. |

Competitive Interest Rates

VA home loan mortgages offer impressively competitive interest rates, making homeownership more affordable for Colorado Springs veterans and active-duty service members.

- Lower Interest Rates: VA loans often feature lower interest rates than traditional loans, reducing overall loan costs.

- No Need for Excellent Credit: Competitive rates are available even for those with less-than-perfect credit scores.

- Protection Against Rate Fluctuations: VA loans provide fixed-rate options to protect borrowers from market volatility.

- Lower Monthly Payments: With reduced interest rates, VA loans ensure lower monthly payments than conventional loans.

Given these advantages, veterans in Colorado Springs can significantly benefit from choosing a VA home loan mortgage.

Collaborating with 719 Lending ensures your investment is managed with exceptional proficiency and customer care.

No Private Mortgage Insurance (PMI)

VA loans do not require private mortgage insurance.

This benefit marks a significant financial relief for many buyers. Not having to pay for PMI means saving potentially hundreds of dollars each month, adding up to substantial savings over time. Typically, lenders charge PMI when the borrower makes a down payment of less than 20% of the home’s purchase price.

Saving money on PMI makes homeownership more accessible.

Furthermore, this absence of PMI contributes to the overall affordability of VA loans – one more reason why they remain a top choice for veterans and active-duty service members. These financial benefits enhance home-buying opportunities and allow potential homeowners to allocate their resources more effectively.

For veterans residing in Colorado Springs, 719 Lending can tailor this advantage to align with your unique financial goals, helping you make the dream of owning a home a reality much sooner. When you choose to work with 719 Lending, you’re choosing a partner committed to your long-term success.

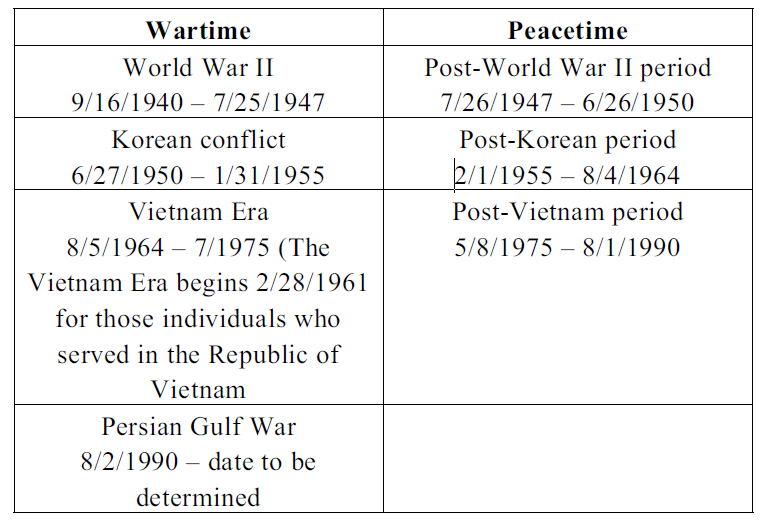

Eligibility Criteria for VA Loans

Understanding the eligibility criteria for VA loans is vital for prospective homebuyers seeking this extraordinary benefit, as it offers access to potentially life-changing opportunities and savings.

Generally, you must have suitable credit, sufficient income, and a valid Certificate of Eligibility.

Those who are eligible include veterans, active-duty service members, and some members of the National Guard or Reserves, each needing to meet a specific set of service requirements often based on time served.

This eligibility process, however, is just the start of your journey to a brighter future. 719 Lending is prepared to assist you every step of the way, offering guidance to navigate these requirements, so you unlock competitive mortgage opportunities. To begin this empowering path, connect with 719 Lending and understand how your service can seamlessly transition into prosperity and homeownership.

Potential Drawbacks of VA Loans

While VA loans provide incredible benefits, a handful of considerations may arise. For instance, they often come with a mandatory funding fee, which can be hefty. Additionally, certain properties may not qualify, limiting options in the vibrant Colorado Springs real estate market. It’s crucial to thoroughly assess all aspects and partner with a knowledgeable mortgage professional like 719 Lending to navigate these complexities effectively.

Funding Fee Requirement

When contemplating a VA home loan mortgage, it’s essential to understand the funding fee requirement, which helps sustain the longevity and viability of the benefit for future veterans.

Typically, this fee varies depending on several factors, including the borrower’s service history.

If you are a first-time buyer, the fee is generally lower compared to subsequent uses of the VA loan. Moreover, veterans with a service-related disability are often exempt from this particular fee, easing the financial burden associated with obtaining a loan.

Navigating the funding fee requirement is critical, as this additional cost can influence your overall financial planning. At 719 Lending, we are committed to guiding you through understanding these fees in the context of your personal financial picture. By working with a knowledgeable mortgage professional, you can explore options and strategies to reduce upfront costs and enhance your home-buying experience in the Colorado Springs real estate market.

Property Restrictions

When considering a VA home loan mortgage, potential property restrictions may affect your buying options and future plans.

Primarily, the VA home loan mortgage program is designed to finance primary residences, limiting the purchase of vacation homes or investment properties. This restriction ensures that veterans and service members are provided housing stability in their primary residences. Additionally, certain properties might require approval to meet VA’s Minimum Property Requirements (MPRs), which safeguard against issues like inadequate heating or roofing problems.

Furthermore, homes need to be a certain type of construction or classification to qualify for VA-backed financing. For example, manufactured homes may require additional steps to comply with VA guidelines, potentially complicating the purchase process or requiring specific modifications before approval.

Understanding these property restrictions enables borrowers to make informed decisions and avoid potential setbacks in their home-buying journey. By aligning closely with 719 Lending, you can navigate the complexities and nuances of property compliance, ensuring that your path to homeownership in the Colorado Springs real estate market is smooth, strategic, and tailor-made for your unique needs.

Longer Closing Process

Embarking on a journey with a VA home loan mortgage can sometimes mean encountering a longer closing process, which may take several more weeks compared to conventional loans.

This is because VA loans involve additional steps and specific requirements that must be fulfilled.

For instance, the need for an appraisal to ensure the property meets VA’s standards can add time to the process, as can coordination with VA-approved lenders, brokers, and service providers.

However, the extended timeline is a small price to pay for the myriad benefits that a VA home loan mortgage offers, such as no down payment and competitive interest rates. Careful planning and collaboration with seasoned mortgage officers at 719 Lending can mitigate potential delays. Ultimately, patience and diligence allow for a rewarding home-buying experience tailored to your needs in Colorado Springs’ vibrant housing market.

VA Home Loan Limits

Understanding VA home loan limits is crucial in planning your home-buying journey. These limits identify the maximum amount the Department of Veterans Affairs will guarantee, and they vary based on location.

In Colorado Springs, homebuyers enjoy higher loan limits due to local housing costs. This benefit allows veterans to purchase more expensive homes without a significant down payment.

Notably, in 2020, the VA removed loan limit restrictions for eligible veterans with full entitlement. Consequently, veterans can obtain a VA home loan mortgage beyond typical county limits, providing enhanced purchasing flexibility and reflecting today’s expansive real estate realities.

Prospective buyers must check for “limits” to ensure their housing choices align with their financial plans. This empowers veterans to pursue their homeownership dreams confidently, benefiting from tailored guidance and support from mortgage professionals like 719 Lending. Keep in mind, knowledgeable mortgage brokers are key to navigating these freedom-empowering benefits.

How to Apply for a VA Loan

Embarking on the path to securing a VA loan requires clarity, diligence, and a keen understanding of the process. Thankfully, a streamlined method is in place to guide eligible veterans.

First, determine your eligibility with the Department of Veterans Affairs by obtaining your Certificate of Eligibility (COE).

Next, gather necessary financial documents, such as your income and employment records, which demonstrate your repayment capability.

Once you have your COE, contact a trusted local lender, like 719 Lending in Colorado Springs, to begin your loan application.

Provide your lender with the required documentation and undergo a credit check to assess your financial health. Lenders use this information to estimate the loan amount you are qualified for, considering your creditworthiness and income level.

Finally, after completing these steps, expect to receive a detailed assessment of your loan terms. This empowers you to move forward confidently with your home-buying journey, ensuring financial clarity.

Importance of Pre-approval

Securing pre-approval for a VA home loan mortgage is the cornerstone of a successful home-buying journey. Pre-approval verifies your financial credibility and provides an estimation of your borrowing capacity.

In 2016, financial experts, including seasoned mortgage brokers, emphasized how pre-approval allows homebuyers to refine their focus. By doing so, they can concentrate on properties within their actual budget, avoiding overreaching.

Moreover, it’s not just homebuyers who value pre-approval. Sellers appreciate knowing a buyer’s ability to secure financing. This can give you a competitive edge when negotiating prices and terms for your dream home.

While the process of pre-approval requires thorough documentation, it clears the path for faster closings. This early step helps to mitigate potential delays and complications by ensuring every financial aspect is pre-vetted.

Choosing to get pre-approved not only streamlines your search but also projects financial preparation, making your offer more appealing to sellers.

Choosing the Right Mortgage Lender

Selecting a mortgage lender is a foundational step in your home-buying process and requires careful consideration. Why is this so vital?

In Colorado Springs, prospective homeowners can find a variety of lenders eager to assist with VA home loan mortgages. Each lender offers distinct terms, fees, and levels of customer service. Thus, understanding these variations is crucial.

Seek reputable lenders who align with your financial goals and understand your unique needs, especially when dealing with VA home loans. 719 Lending stands out as a prime choice, offering local expertise and personalized service.

They will guide you through complex financial landscapes to ensure you receive optimal terms for your circumstances. In addition, building a relationship with a trustworthy lender like 719 Lending can have long-term benefits.

Choosing wisely can enhance your overall home-buying experience, paving the way for a smooth, satisfying journey.

How VA Loans Compare to Conventional Loans

VA loans offer distinct advantages over conventional loans.

Firstly, VA loans generally do not require a down payment, which creates an opportunity for qualified veterans to purchase homes with minimal upfront costs. This is in stark contrast to conventional loans, where down payments typically start at 3% and can go up to 20%. Furthermore, without private mortgage insurance (PMI) required on VA loans—unlike conventional loans which mandate PMI with less than 20% down—the ongoing cost savings are profound for eligible borrowers.

The underwriting for VA loans focuses on veterans’ unique situations.

In contrast, conventional loans depend heavily on credit assessments. VA loans, however, consider the overall financial picture more comprehensively, making them accessible to those with diverse financial backgrounds.

For homebuyers in Colorado Springs, particularly veterans navigating the local real estate market, choosing a VA home loan mortgage can be a strategic move. It allows lingering financial concerns to take a back seat—facilitating focus on finding the perfect home. As of 2023, VA loans continue to offer unparalleled benefits, and with Colorado’s vibrant housing market, these loans can be pivotal. Seek guidance from 719 Lending to embark on this advantageous home-buying journey.

Impact on Colorado Springs Real Estate Market

VA loans shape the dynamics of home buying.

The influence of VA home loan mortgages on the Colorado Springs real estate market is significant. By providing veterans and active-duty service members with competitive interest rates and no down payment requirements, these loans enable more residents to enter the housing market. Consequently, they foster increased demand, contributing to the area’s economic vitality.

This increase in demand supports the local property values.

With more veterans feeling empowered to purchase homes—at times without the immediate need for substantial savings or credit scores—the market diversity broadens, welcoming varied demographics. Hence, real estate professionals in the city have witnessed firsthand the positive ripple effects that VA loans impress upon market activity.

In essence, the VA loan’s availability energizes Colorado Springs’ housing sector by enhancing accessibility and promoting home ownership among eligible community members. This mechanism ensures that veterans are consistently integral to the lifeblood of the city’s growth. By doing so, 719 Lending emerges as a key supporter, fostering these transitions into homeownership.

Common Myths about VA Loans

VA home loan mortgages often carry myths, causing some potential borrowers to shy away despite the numerous advantages they boast.

For example, one misconception is that a significant financial burden accompanies these loans, which is largely untrue, thanks to favorable terms like no down payment and limited closing costs. This myth persists but is not grounded in reality, as veterans generally benefit from reduced financial strain compared to conventional loans. Ultimately, the misunderstanding about costs prevents some from tapping into the benefits designed for them.

Additionally, some believe VA loans are cumbersome in their approval process. In contrast, many find the process straightforward; lenders familiar with VA loans, such as 719 Lending, simplify the journey significantly by handling much of the paperwork efficiently.

Finally, it’s falsely assumed that VA loans are a one-time benefit—an incorrect notion as they can be reused, provided previous loans are paid in full. This extraordinary flexibility allows veterans to leverage their VA loan eligibility over their lifetime, facilitating homeownership transitions and purchases with greater ease and fewer financial setbacks.

Tips for First-time Homebuyers

Embarking on the journey of purchasing your first home is an exhilarating yet daunting adventure. By arming yourself with knowledge, you can make this process smoother and more rewarding.

Experts suggest that securing mortgage pre-approval is a crucial initial step for all prospective buyers.

This action not only helps you understand your budgetary limits but also prepares you as a more appealing candidate in a competitive housing market. It fosters confidence, knowledge, and optimism in your home-buying journey.

Additionally, engaging with a valued partner like 719 Lending in Colorado Springs can provide essential guidance tailored to your needs. They assist in thoroughly understanding various mortgage options, ensuring informed decisions. Remember, perseverance and patience are “key” to realizing that dream home.